Additional Information

You will find topics like: Fee-For-Service vs. Value-Based Care, Process Overview, Coding & Billing, Revenue Cycle Management, References

Healthcare Management

FEE-FOR-SERVICE

In a fee-for-service payment model, health plans reimburse providers for each service they provide to patients, regardless of the outcome.

This is the status quo in healthcare coverage. Providers may enjoy more control over their salaries and schedules in fee-for-service models, according to the American Medical Association (AMA). They also might find that the simplicity of fee-for-service reimbursement gives them more flexibility in styles of medical practice and work effort.

Fee-for-service health plans typically have no provider networks and no referral requirements, but members may face higher costs. Some fee-for-service plans are preferred provider organizations (PPOs). In non-PPO plans, members can receive care by visiting a doctor or hospital of their choice. In PPO plans, out-of-pocket costs may be lower for those who see a listed PPO provider.

Members with fee-for-service plans may be required to provide upfront payments for care and then submit claims for reimbursement.

The payment model is most commonly associated with traditional Medicare. Traditional Medicare, also called Medicare fee-for-service, includes hospital insurance through Medicare Part A and medical insurance through Medicare Part B. Beneficiaries pay a monthly Part B premium and have a 20 percent coinsurance for Part B services after meeting their deductible.

Payment rates for providers who participate in Medicare are determined by prospective payment systems , which establish reimbursement rates based on a fixed amount. Prospective payment systems differ by provider type, with CMS releasing new ones each year.

Although the healthcare industry is used to fee-for-service, the reimbursement model creates barriers to quality care, hinders care coordination, and spurs high healthcare costs. This system may promote overutilization and incentivize providers to deliver excessive treatments, as their payment relies on the quantity of care rather than the quality.

As a result, health plans and other stakeholders have started shifting to value-based payment models.

VALUE-BASED CARE

Unlike fee-for-service, value-based care models reimburse providers based on the quality of the care they deliver. Value-based care programs aim to hold providers more accountable for patient health outcomes by offering financial incentives. The approach centers around the triple aim of improving population health management, reducing healthcare costs, and improving the healthcare experience.

Health plans operating under value-based care models use quality measures to determine provider reimbursement. Common utilization measures include emergency department use, hospital readmissions, average length of stay, and prescription drug utilization.

Health plans often use the National Committee for Quality Assurance’s (NCQA) Healthcare Effectiveness Data and Information Set (HEDIS) to measure care quality. HEDIS measures shed light on the effectiveness of care, availability of care, and service utilization.

CMS also offers several models that incentivize different quality measures. For example, the Hospital Readmissions Reduction Program (HRRP) uses the excess readmission ratio to assess hospital performance. Hospitals receive financial penalties in the form of payment reductions if their all-cause 30-day readmission rates exceed the average among hospitals with similar patients.

Value-based models can have upside-only risk, meaning providers can benefit financially from meeting or exceeding quality and cost targets. Other models, like HRRP, include downside risk where providers are penalized for not meeting targets. Models with both upside and downside risk, known as two-sided risk, may lead to better outcomes, according to past research.

Process Overview

workflow

Coding & Billing

Principal Care Managment

Principal Care Management (PCM) is a Medicare-backed program that healthcare providers can use to engage patients in proactive chronic disease management. It is similar to Chronic Care Management (CCM), but PCM is refined in scope to treat one, isolated chronic condition.

Patient qualifications for PCM include:

- A diagnosis is expected to last between, at minimum, three months to life-long.

- The condition being treated must place the patient at significant risk of death, acute exacerbation or decompensation, or in a state of functional decline, and/or be associated with a recent hospitalization.

- Written or verbal patient consent documented by your practice.

Consent documentation for PCM can be managed with care coordination software, a helpful tool, especially in case of a Medicare audit.

PCM services are delivered through remote interactions, easing the burden of patient travel to your practice. These services can include:

- A monthly clinical review

- Telephone calls

- Physician reviews

- Referrals

- Prescription refills

- Chart reviews

- Scheduling appointments/services

Services rendered are driven by the patient’s individual care plan, which is created in collaboration with the patient upon PCM enrollment. Care plans serve as a comprehensive guide to a patient’s goals, health history, and behavior.

PCM can strengthen the relationship between your patients and your practice. The program’s structure, with monthly touchpoints and care team access, can improve patient engagement.

Medicare Part B covers 80% of this benefit for patients. Providers can be reimbursed for offering this service.

How to Bill for Principal Care Management

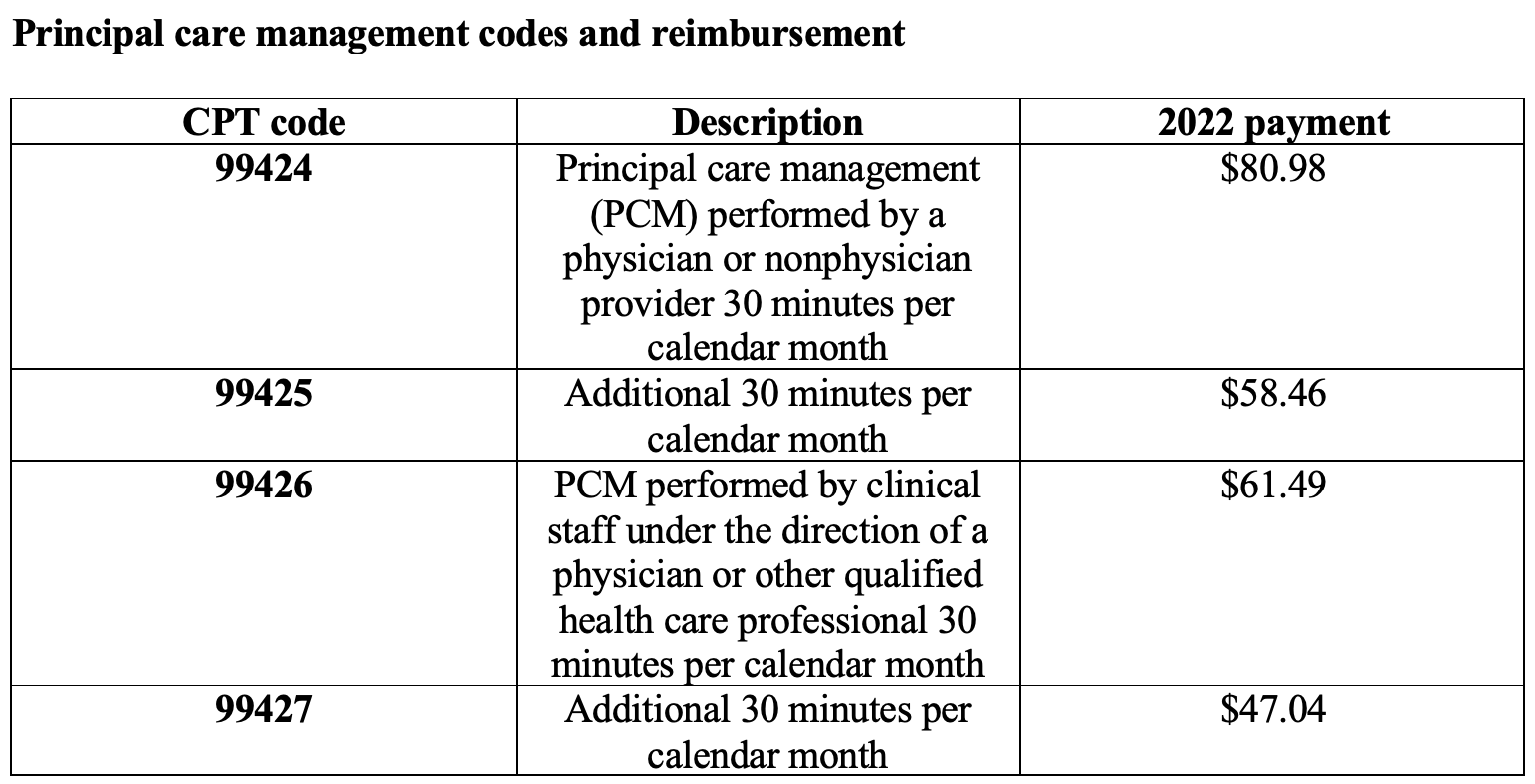

Effective in 2022, Medicare began accepting four new current procedural terminology (CPT) codes for principal care management (PCM) and discontinued two Healthcare Common Procedure Coding System G codes. Experts say the new codes, which are paid at a higher rate than the G codes, afford physicians the opportunity to improve outcomes while simultaneously generating additional revenue.

What are the codes?

Unlike CCM with a 20-minute requirement for billing, PCM has a 30-minute requirement for billing reimbursement. It is an important distinction.

Five items are required when submitting a claim through CMS:

- CPT codes for each program you are managing for the patient.

- ICD-10 codes tied to each of the conditions you are managing within that program.

- Date of service

- Place of service

- National Provider Identifier (NPI) number

It is not necessary to know the care manager assigned to the patient, but it is helpful in case of an audit. When billing, calculate the time spent with each of your patients monthly.

Four steps are required to bill for PCM:

- Verify CMS requirements were met for each patient each month

- Submit claims to CMS monthly

- Send an invoice to patients receiving PCM services monthly.

- are no conflicting codes that have been billed.

Chronic Care Management

Here are some billing guidelines for Chronic Care Management (CCM):

-

- Only one practitioner may be paid for CCM services for a given calendar month.

- Eligible practitioners include Physicians, Certified Nurse-Midwives, Clinical Nurse Specialists, Nurse Practitioners, and Physician Assistants.

- CCM services must be initiated by a visit.

- CCM coding is required.

- Phone calls are not required to meet minimum monthly time.

- Time may not be carried over to the next month.

- Billing is not required every month.

- Service does not have to be in-house, but the provider must be accessible.

- You can bill transitional care management and CCM in the same period if the work does not overlap.

- Manual time tracking takes too much admin time.

Revenue Cycle Mangement

Revenue Cycle Management (RCM) in healthcare is the process used by healthcare systems to manage financial operations related to billing and collecting revenue for medical services. It encompasses several key steps:

- Appointment Scheduling: This step involves determining the need for services, collecting patient name, contact information, and insurance coverage details.

- Registration: During registration, patient intake is completed, including insurance verification, front-desk collections, and collecting patient demographics.

- Charge Capture for Services: Medical procedure and diagnosis codes are assigned for the encounter.

- Billing: Clean claims are created to receive reimbursement from insurers and provide bills for patients.

- Denial Management: Regularly reviewing denial reason codes helps determine why a claim was denied and make corrections to prevent future denials.

- Accounts Receivable (A/R) Follow-Up: Identifying and following up on unpaid charges.

The overall goal of RCM is to increase and ensure accurate revenue throughout the various processes of the cycle by identifying points of deficiency and then improving or eliminating those deficiencies. Efficient RCM also helps healthcare organizations comply with regulatory requirements and improve patient satisfaction. It plays an essential role in the day-to-day operations of healthcare organizations, ensuring correct and timely payments while optimizing financial performance.

Benefits of healthcare RCM include strengthening revenue, minimizing claim denials, reducing days in accounts receivable, and increasing collections. Additionally, effective RCM provides a structured approach to addressing potential compliance issues like fraud, waste, and abuse, contributing to the overall functioning of the healthcare industry.